Impact of GST in Indian Market-A Literature

Main Article Content

Abstract

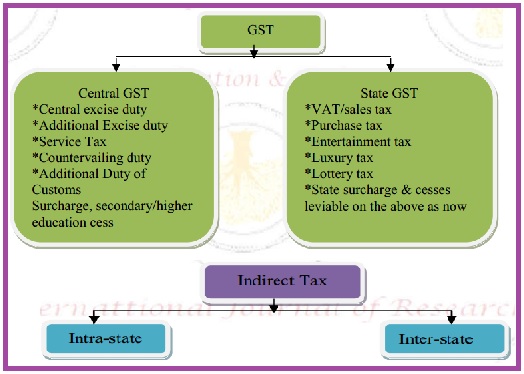

Indian market, new tax reformed scheme was introduced to generate government’s revenue equally between the state and center. This scheme was introduced by the center government because of the conflicts made by state governments between the state and center tax were implemented by the state governments which varies one state to another state of the country. Earlier policy was like a tax upon tax implemented on the goods and services and it was again between producer and consumers, which we call it as one type of monopoly, broken by the center government. But due to this Goods and Service Tax introducing in Indian markets reflects on the small scale and medium scale manufacturing units. So this paper focused on to my notion, this GST implementation policy is like a ‘‘Wet and Draught’’ unemployed, which were dependant on those bussinessman facing problems and due to that they shutdown/reduced their industrial work. Such relevant affects was shown only after GST introduced. Generally, it was slogan as “One Nation, One Tax and One Market” and finally termed as GST.